Percent of Deduction Calculation Method

Deductions and Benefits > Benefits

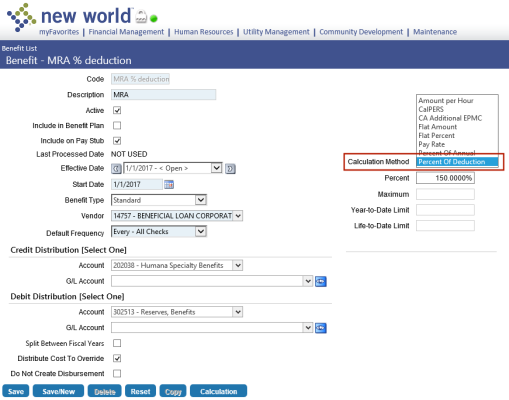

To let you set up a benefit to be calculated as a percent of associated deductions, a Percent of Deduction option has been added to the Calculation Method drop-down on the ![]() Benefit page.

Benefit page.

With this option, when a deduction limit changes, the benefit automatically will be calculated as a ratio of the limit.

The Percent of Deduction may exceed 100%; for example, if the benefit is 150% of the associated deductions, the benefit will be calculated as 1.5 times the deduction limit.

Selecting Percent of Deduction displays and enables the following fields below the Calculation Method drop-down:

- Percent

- Maximum

- Year-to-Date Limit

- Life-to-Date Limit

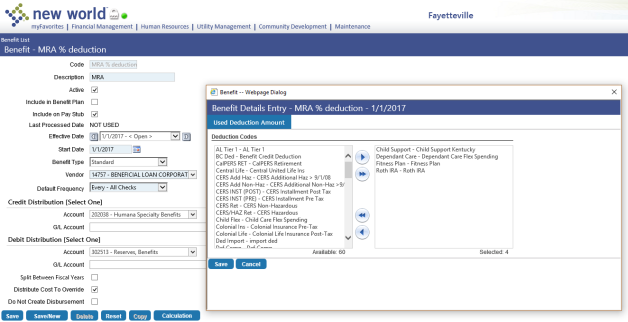

For a benefit with a calculation method of Percent of Deduction, the Benefit Details Entry dialog, opened by clicking the Calculation button, contains a ![]() Used Deduction Amount tab for selecting the deduction codes that apply to the selected benefit.

Used Deduction Amount tab for selecting the deduction codes that apply to the selected benefit.

Note: Only deductions that are not part of a benefit plan are available for selection.

The payroll calculation, Position Budgeting calculation and Workforce Administration have been updated to support the Percent of Deduction calculation.

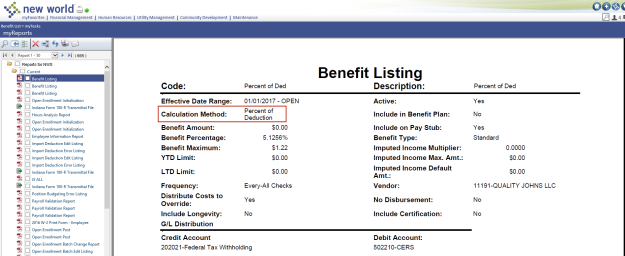

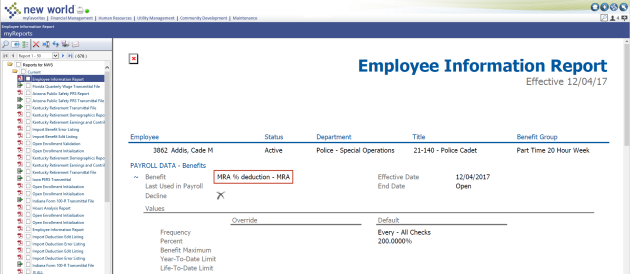

The ![]() Benefit Listing and Employee Information Report also have been updated to include the new calculation method.

Benefit Listing and Employee Information Report also have been updated to include the new calculation method.